Vienna 8/23/2022

NGO Non-Government Organization Commonly referred to as non-governmental organization, according to Wikipedia is: organization that generally is formed independent from government. The best-known NGOs are Greenpeace and Amnesty International.

The very idea of an NGO is very noble and definitely worth our approval. When a group of people are committed to the worthy cause of humanitarian aid, the protection of people, animals or the environment, they deserve recognition and support. NGOs do not pay taxes or insurance premiums because by definition they are not there to make money.

This tax-avoiding opportunity has been used extensively by the world’s wealthiest individuals and corporations to drastically reduce the costs borne by tax authorities. I emphasize that not all NGOs are used in this way, only some of them.

Imagine you have a large company with multi-million dollar profits. These winnings must be taxed under the laws in force in most countries around the world. Depending on the country, around half of this wealth would have to be spent on taxes alone. It hurts when you have to donate tens of millions of dollars to the tax authorities.

However, there is a solution: such a businessman creates an NGO and donates, for example, 90% of the company’s profits. After such an operation, your own company only pays the tax office 10% of what it would have paid without the NGO. They will say, but this money belongs to the NGO, not this entrepreneur. It’s true, but it doesn’t matter who owns the money – it matters who manages the money. Our businessman planning a vacation in Hawaii declares it as a cultural exchange support trip and the NGO covers all expenses.

Anyone running a business will be thinking right now, why am I paying taxes, I am going to start an NGO, and I am going to have more of my hard-earned money too. Unfortunately, this possibility in tax law is only reserved for the very, very rich. We still have to pay taxes. Since we do not influence our country’s tax laws, we cannot afford the expense of creatively influencing legislation. And if we could afford it, we would also limit the ability of the poor to take advantage of these tax loopholes. At some point the state would cease to function without taxes, and billionaires wouldn’t want that either.

Quote from the book “Inside Corona” by Thomas Röper:

When Soros and all his foundations fought to save Ukraine from bankruptcy after the Maidan in 2014, he was primarily concerned with political goals and five billion dollars. He had invested $5 billion in Ukrainian government bonds, and if Ukraine had defaulted, the $5 billion would have been gone. It’s a good thing that Soros, with his Open Society Foundation, has secured enough political and media power since 1993 to drum for “democracy” in Ukraine and for the EU to save the country from bankruptcy with billions in taxpayers’ money. In the years that followed, the EU supported Ukraine with well over ten billion euros in order to save Soros’ five billion and gain political influence in Ukraine.

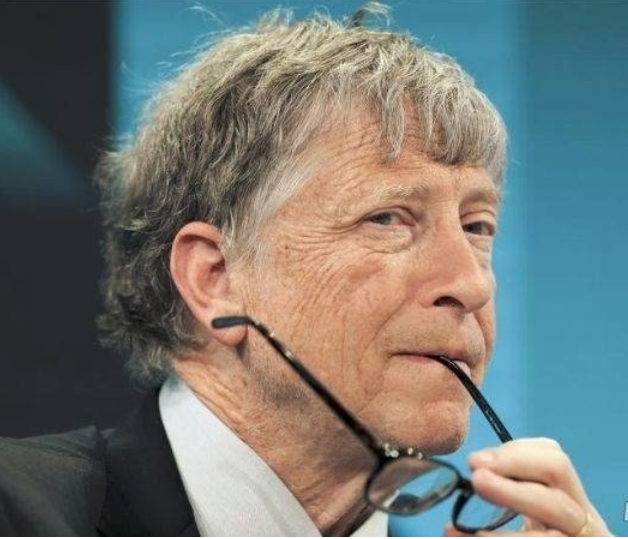

And Bill Gates, who is said to be spending his money lavishly to save the world from everything and fight poverty, is doing no different. He has transferred his fortune to a foundation, the Bill & Melinda Gates Foundation, and now pays virtually no taxes. And although, if we are to believe the media, Gates spends his money lavishly on saving the world, he (or rather his foundation) is getting wealthier. He set up his foundation in 1999. In 2001 he had assets of around 55 billion dollars. Today it’s more than double, nearly $130 billion. […] How does it work?

Quite simply: he didn’t donate the vast majority of his money, but invested it. He bought shares in companies like BioNTech or Pfizer, and when the companies make a profit, Bill Gates not only earns from the profits, but also from the price gains on the stock exchange.

NGOs, including those founded for fair and charitable reasons, can become easy prey for “philanthropists” like Bill Gates. If someone offers a selfless donation of millions of dollars, most of these companies will gratefully accept it and start investing to achieve the planned goals. Subsequent donations come with innocent strings attached that increasingly contradict the fundamental goals of this NGO.

There are very few people who could say no to such a “benefactor”. If the NGOs invest the received donations in a large and useful project, it will be difficult for them to stop the project afterwards, which usually requires further investments. And these donor conditions still seem appropriate.

The tragedy of the recent pandemic would not have been possible without the help of NGOs such as Open Philanthropy and NTI – Nuclear Threat Initiative. There are many such criminal organizations, but I would like to emphasize again that not all NGOs should be treated as criminal organizations. I will write more about the role of NGOs in spreading the pandemic. For those who are interested, I recommend the book mentioned – Thomas Röper “Inside Corona”.

Author of the article: Marek Wojcik